Beginning AP

It is quite common that Accounts Payable is not converted from your previous system into EPASS. This will show you how to enter the beginning balances for suppliers.

Sign-in and Transaction Date: It is very important to sign-in as a date prior to going live when processing these beginning transactions. This will post these transactions to the G/L as a prior period, and it will be very easy for the EPASS technical support team to clear it out of the G/L. In our example our company is going live April 1st, so we are signing in as March 31st.

Steps

-

Keying in Invoices

-

A/P Posting

-

Reconciling with the A/P Open Item report

Keying In Invoices

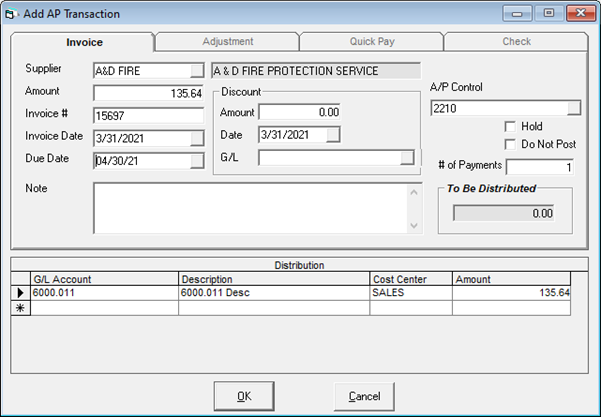

AP > Transaction Processing > Add > Invoice

-

Supplier: The browse button is available to search suppliers.

-

Amount: The balance of the invoice. It is much easier to key in one entry for the balance of the invoice versus multiple entries for any payments and adjustments. Your previous software system or final AP report from the previous system can always be kept to answer questions.

-

Invoice #: The invoice number from the previous system.

-

Invoice Date: The date of the invoice, this must be prior to the ‘going live’ date.

-

Due Date: The true due date of the invoice. This date does not need to be prior to the ‘going live’ date.

-

Note: A simple note to remind you this was startup is always helpful.

-

Discount Amount/Date/G/L: If this invoice involves an early payment discount, you will want to fill these fields in.

-

A/P Control: Defaulted from AP variables normally does not change.

-

Hold checkbox: If there is a dispute with this invoice you can put it on hold immediately.

-

# of Payments Used: If the invoice is split into three payments over 90 days, or something similar.

-

To be Distributed: The system will show the amount of money left to be distributed.

-

G/L Account: It is suggested to use one GL account for all beginning AP, but what account you use does not matter since the G/L transactions will later be cleared out by the EPASS technical support team.

-

Description: Filled in by the system.

-

Cost Center: Enter the Cost Center, if applicable.

-

Amount: Defaulted to the amount keyed in above. When ‘To Be Distributed’ is zero, you can click OK.

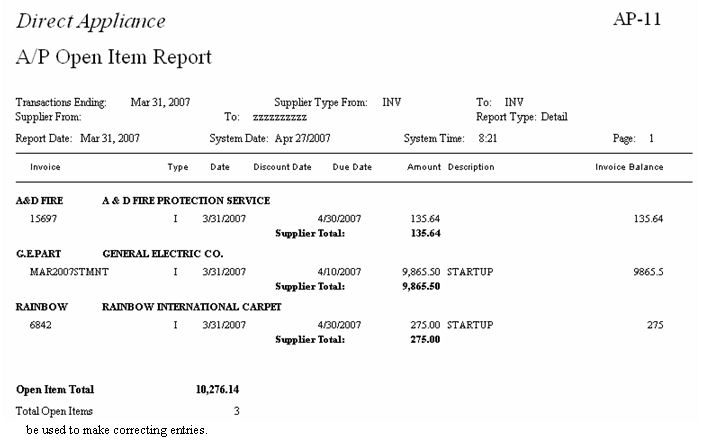

Variation

If you do not want to key in each invoice for some suppliers, you could simply key in one entry per monthly statement as their total AP balance. This is quite common for parts suppliers where you have hundreds of invoices throughout the month. In this case you would change the Invoice number to be a word like ‘STARTUP’ or ‘MARCH2007-STMNT’. EPASS has no problem with invoice numbers being words. Although this method would be faster, it will require more regular referrals to your previous system to research payments and balances.

A/P Posting

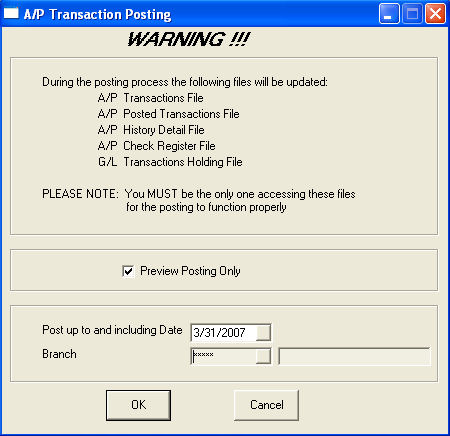

AP > Post Transactions

Make sure you are signed in as the correct date prior to posting. It is best to post small batches at a time. This will make it easier to find errors. If you are working from a printout from your previous system, maybe post every time you key in a couple of pages worth of entries.

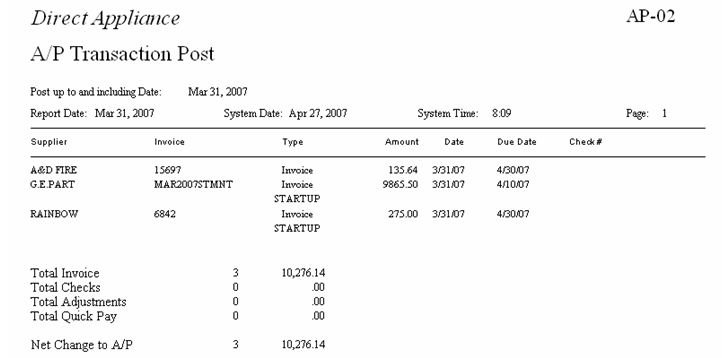

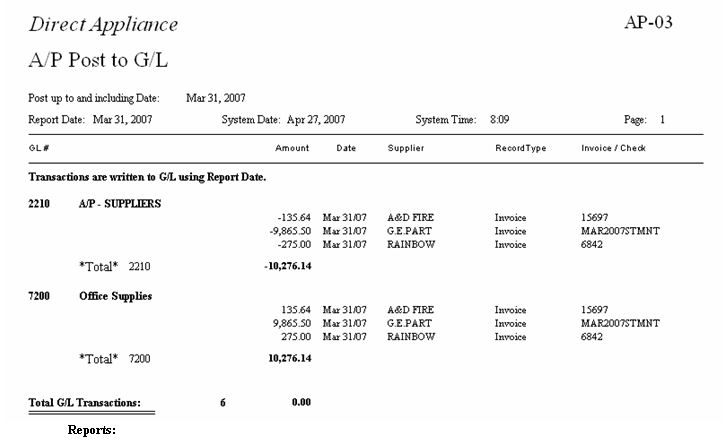

Reports

It is easiest to use the AP-02 AP Transaction Post report to balance your work. The second report gives GL breakdown, which will not be relevant since we are putting all suppliers to the same GL Account. It is important to remember we are doing this because these startup entries will be cleared from our GL, and later on you will be keying in beginning entries for the EPASS GL.

Reconciling with the AP Open Item Report

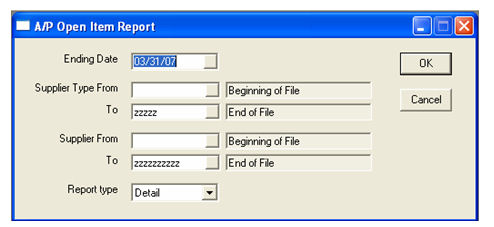

AP > Reports > AP-11 AP Open Item Report

Once all the postings are complete, you need to do a final reconciliation. With each posting being checked, the AP Open Item report should match your listing from your previous system. Make sure to select ‘Detail’ for the report type.

Now go through the AP Open Item and compare the totals with your previous system. As long as they match, you did everything correctly. If some mistakes were made, AP Transactions > Add > Adjustment can be used to make correcting entries.

December 30, 2021